How CMOs Choose B2B Marketing Automation Vendors for Scalable Growth

Marketing automation now underpins how B2B organizations manage demand generation, buyer engagement, and pipeline acceleration. For CMOs, vendor selection defines far more than campaign execution. It shapes how data moves across teams, how buyers progress through the funnel, and how revenue leaders measure performance with confidence.

The modern CMO marketing automation vendor decision reflects a shift from tactical tooling to enterprise infrastructure. Automation platforms must operate as part of a wider revenue system that includes CRM, analytics, enablement, and sales execution. Each choice influences data quality, reporting integrity, operational alignment, and the organization’s ability to scale demand efficiently.

This article examines how CMOs choose B2B marketing automation vendors through a strategic lens that balances growth goals with system discipline.

Quick Takeaways

- CMOs evaluate marketing automation vendors based on integration strength, data reliability, and revenue alignment.

- Vendor scalability determines whether platforms support long-term demand generation growth.

- Data governance, security, and reporting transparency influence executive buying confidence.

- Long-term vendor value depends on how well platforms support pipeline performance and buyer engagement.

Why Vendor Choice Has Become an Executive-Level Decision

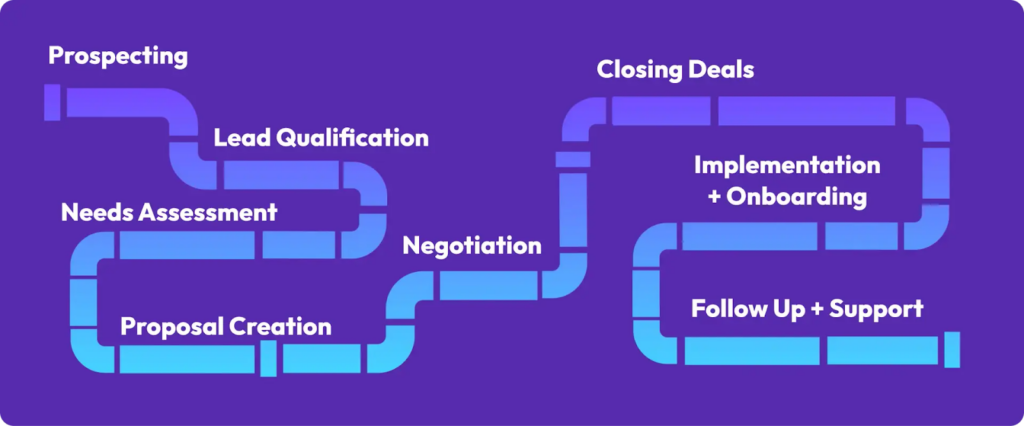

Marketing automation once centered on email distribution and lead tracking. That scope has expanded into full-funnel orchestration, behavioral intelligence, account engagement, and predictive analytics. Vendors now influence how buyers are identified, nurtured, scored, routed, and measured through the revenue lifecycle.

As automation platforms became embedded in revenue systems, CMOs assumed greater accountability for how these tools affect conversion rates, opportunity creation, and forecast accuracy. Vendor selection now influences executive reporting and board-level visibility into go-to-market performance.

The CMO marketing automation vendor decision therefore carries financial, operational, and strategic implications. It is no longer confined to marketing operations teams.

Integration as the First Evaluation Filter

Integration defines whether an automation platform delivers long-term value or creates persistent data friction. CMOs assess how vendors connect with CRM systems, analytics platforms, data warehouses, and revenue operations tooling. Weak integration introduces manual workarounds that undermine reporting accuracy and slow execution.

Disjointed systems fragment buyer data across silos. This reduces visibility into engagement patterns and weakens lead qualification logic. CMOs prioritize vendors that demonstrate stable, scalable integrations with the revenue stack rather than relying on surface-level connectors.

Evaluating Data Flow Across the Revenue Stack

CMOs examine how platforms handle real-time synchronization, identity resolution, and event-level tracking. API maturity, middleware dependency, and vendor support for integration maintenance factor into buying evaluations. The goal centers on preserving buyer intelligence from first interaction through closed opportunity.

The CMO marketing automation vendor decision increasingly depends on how well platforms maintain the integrity of revenue data under sustained operational load.

Data Quality and Buyer Intelligence

Marketing automation influences how organizations interpret buyer intent. CMOs evaluate how vendors handle data normalization, behavioral scoring models, and attribution logic. These functions determine how well teams distinguish active buyers from irrelevant engagement signals.

Poor data quality undermines demand accuracy and erodes trust between marketing and sales. Lead inflation, misrouted accounts, and inconsistent engagement histories disrupt sales prioritization and forecast reliability. CMOs seek vendors that enforce clear data hygiene standards and provide transparent modeling logic.

The strongest platforms support contextual buyer intelligence rather than isolated activity tracking. This distinction shapes the effectiveness of modern demand programs.

Revenue Alignment as a Core Buying Criterion

Automation platforms must reinforce revenue strategy rather than function as campaign tools. CMOs assess how platforms support lead routing accuracy, sales engagement enablement, opportunity progression, and attribution transparency.

Vendors that optimize for short-term engagement metrics without strengthening pipeline health fail to earn long-term digital investment confidence. CMOs evaluate whether platforms integrate with sales workflows and revenue reporting systems that support full-funnel measurement.

The CMO marketing automation vendor decision increasingly reflects how tightly platforms connect marketing activity with revenue contribution.

Scalability and Platform Longevity

Growth introduces operational pressure on automation systems. CMOs evaluate how vendors perform as contact databases expand, campaign volume increases, and account-based programs mature. Scalability affects both infrastructure integrity and operational flexibility.

Platforms that perform well at low volumes often struggle at enterprise scale. Latency, reporting lag, integration instability, and automation misfires introduce execution risk. CMOs prioritize vendors with validated performance across similar organizational size, geographic reach, and data complexity.

Vendor roadmaps also factor into scalability assessments. CMOs examine whether product evolution aligns with emerging AI capabilities, privacy standards, and multi-channel engagement demand.

Security, Governance, and Compliance

Marketing automation platforms now store highly sensitive buyer data across multiple regions. CMOs evaluate security architecture with the same scrutiny applied to core IT systems. Data encryption, role-based access control, audit logging, and breach response protocols receive close review.

Governance extends beyond cybersecurity. CMOs assess how vendors support consent management, privacy compliance, and internal control frameworks. Automation that compromises data integrity or regulatory posture introduces direct enterprise risk.

Strong governance reinforces trust across executive teams. CMO marketing automation vendor decisions now reflect this reality.

Vendor Stability and Risk Exposure

Long-term vendor stability protects organizations from disruptive platform transitions. CMOs assess financial health, product release cadence, support infrastructure, and acquisition exposure. Sudden vendor shifts disrupt campaign continuity and buyer journeys while introducing re-platforming costs.

CMOs evaluate vendor dependency across the revenue stack. Platforms that operate as central orchestration layers carry elevated operational risk if instability emerges. The buying decision therefore weighs contractual flexibility, exit planning, and service reliability alongside technical innovation.

Cross-Functional Influence on Vendor Selection

Marketing automation decisions rarely occur in isolation. CMOs collaborate with CIOs, revenue leaders, data teams, and security stakeholders throughout evaluation cycles. Each group evaluates the platform through different operational requirements.

CMOs focus on buyer engagement, execution efficiency, and demand performance. CIOs assess integration architecture and infrastructure sustainability. Revenue leaders examine pipeline acceleration and sales alignment. Security teams evaluate risk exposure and compliance readiness.

Cross-functional rigor reduces buying bias and improves long-term platform adoption. The CMO marketing automation vendor decision succeeds when executive stakeholders share accountability for outcomes.

The Role of Automation in Account-Based and Buyer-Centric Strategy

Automation has become central to modern account-based programs. CMOs evaluate how vendors support account hierarchies, multi-stakeholder engagement, personalization at scale, and coordinated sales activation.

Buyer-centric engagement now depends on consistent orchestration across email, web, sales outreach, and analytics. Platforms that lack deep account-based functionality struggle to support complex B2B buying committees.

CMO marketing automation vendor strategies increasingly align with account-based execution requirements rather than contact-level campaign logic.

Total Value Versus Feature Density

Feature density alone does not predict performance. CMOs evaluate how well platforms simplify operational execution rather than complicate it. Excessive features often increase training complexity and reduce adoption consistency.

Total value reflects how well automation supports revenue teams in daily execution. CMOs assess enablement resources, partner ecosystems, support responsiveness, and implementation discipline. These factors shape time-to-value far more than feature breadth.

The strongest CMO marketing automation vendor decisions prioritize sustained operational performance over short-term innovation cycles.

Long-Term Performance Measurement

Automation platforms shape how organizations interpret success. CMOs evaluate reporting transparency, attribution logic, and extensibility of analytics models. Executive teams rely on these outputs to guide investment decisions.

Platforms that obscure data logic or restrict reporting flexibility undermine executive confidence. CMOs seek vendors that support adaptable dashboards, cross-channel attribution, and historical trend analysis without requiring excessive customization.

The long-term impact of automation depends on whether leadership trusts the signals these platforms generate.

Master Marketing Automation Today with Televerde

Selecting a B2B marketing automation vendor shapes how organizations generate demand, enable revenue teams, and measure growth at scale. CMOs who prioritize integration strength, data integrity, scalability, and revenue alignment establish platforms that support both near-term performance and long-term growth strategy.

Ready to evaluate marketing automation vendors with confidence? Discover how Televerde helps organizations align automation strategy with demand generation and pipeline performance. Contact us to learn more.