The CFO’s Guide to Justifying Demand Generation Budgets

CFOs play a key role in determining how revenue organizations invest in growth. As budgets tighten and expectations rise, demand generation teams must prove that their programs support predictable revenue and long-term financial health. CFOs evaluate demand generation through marketing insights and financial indicators, examining how these investments influence cost structure, risk management, revenue timing, and organizational efficiency. This requires a financial and operational view that demonstrates measurable outcomes and the processes that create them.

Clear justification helps CFOs understand the direct financial return of demand generation budgets and the stability these programs add to the pipeline. When marketing and finance align, forecasting improves, revenue becomes more predictable, and the organization gains a clearer path to sustainable growth.

Quick Takeaways

- CFOs evaluate demand generation through financial impact, risk reduction, and operational efficiency.

- Budget justification improves when marketing ties KPIs to CAC, LTV, conversion consistency, and forecast accuracy.

- High-quality demand generation strengthens revenue predictability and reduces volatility across the sales funnel.

- CFOs expect attribution clarity and a clear explanation of how each investment links to pipeline creation.

- Strong alignment between finance and marketing improves investment decisions and long-term growth strategy.

How CFOs View Demand Generation Investments

CFOs are responsible for managing spend with the same rigor they apply to forecasting, cash flow, and planning. They need to understand how demand generation contributes to revenue timing and financial stability. Instead of evaluating campaigns at a tactical level, they examine how the entire demand engine influences the health of the business.

This includes assessing:

- Efficiency of each dollar spent

- Predictability of pipeline creation

- Conversion trends across the funnel

- Stability of revenue forecasts

- Cost risks tied to inconsistent demand

When demand generation shows discipline in these areas, CFOs see it as an investment in predictability, not an expense line that fluctuates quarter to quarter.

Building a Financial Case CFOs Can Trust

Justifying demand generation budgets begins with translating marketing results into financial terms. CFOs need a clear connection between spend and expected outcomes, rooted in consistent data and reasonable assumptions.

Customer Acquisition Cost (CAC)

CFOs want to understand how demand generation contributes to lowering CAC or stabilizing it over time. Clear, repeatable processes reduce the cost of wasted engagement and create a more efficient path to qualified opportunities.

Lifetime Value (LTV)

A larger pipeline generated through high-quality demand generation allows sales teams to be more selective, improving overall customer fit. Stronger fit leads to higher retention, which directly increases LTV.

Payback Period

CFOs evaluate how long it takes for new customers to cover initial acquisition costs. Consistent demand generation shortens this cycle by supporting more reliable conversion rates.

Forecast Accuracy

Demand generation influences the stability of forecasts. A steady flow of qualified opportunities reduces quarter-end uncertainty and improves confidence in revenue planning.

When demand generation demonstrates influence across these metrics, CFOs see financial justification rooted in measurable efficiency and reduced volatility.

Highlighting Operational Value CFOs Care About

Financial justification alone isn’t enough. CFOs also need to understand the operational foundation behind the numbers because reliable growth depends on consistent processes, not isolated wins. The operational value of demand generation provides the context CFOs need to confirm whether budgets are supporting scalable, efficient growth.

Improved Lead Quality and Qualification

CFOs focus on operational efficiency. High-quality leads reduce wasted sales effort, shorten sales cycles, and improve conversion predictability. When marketing delivers consistent quality, finance gains confidence in pipeline reliability.

Stronger Alignment Across Sales and Marketing

Demand generation supports a coordinated handoff between teams. CFOs know that misalignment creates hidden costs like inefficient follow-up, lost opportunities, and inaccurate forecasts. Strong alignment reduces these operational risks.

Funnel Consistency

Demand generation structures repeatable processes around buyer engagement. Consistency matters to CFOs because it stabilizes the revenue engine. Programs tied to a disciplined nurture motion, defined SLAs, and repeatable follow-up patterns are easier to evaluate from a financial perspective.

Speed to Lead

Faster response times reduce leakage and support higher conversion rates. CFOs understand the operational cost of slow follow-up. Demand generation programs that support timely engagement deliver measurable improvements in efficiency.

Using Data and Attribution to Strengthen the Business Case

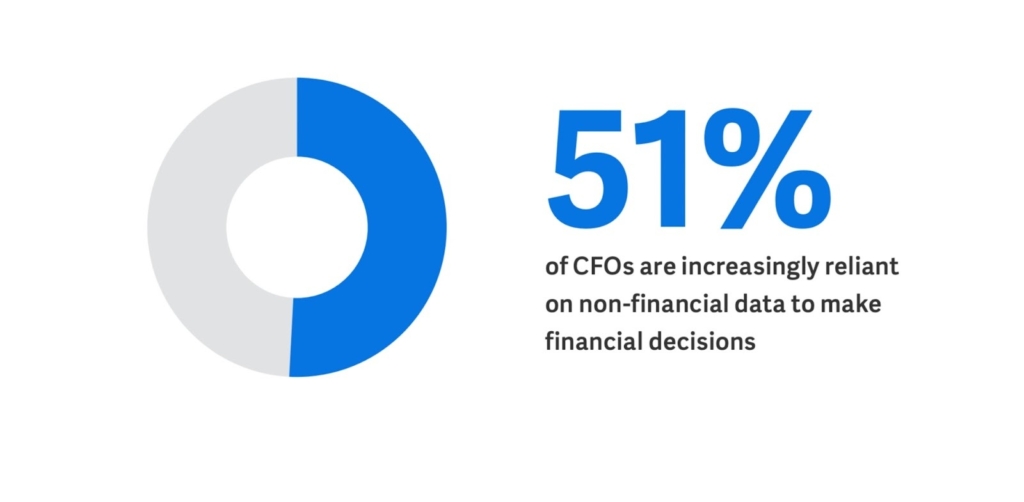

Modern CFOs expect transparency. Clear attribution models help connect spend to results, reduce uncertainty, and support confident planning.

Marketing should present data with enough specificity to show how each investment supports pipeline creation.

This includes:

- Channel-level performance clarity

- Insight into both sourced and influenced pipeline

- Visibility into progression through each stage

- Reporting that aligns with sales and finance systems

Demand generation budgets become easier to justify when CFOs see that marketing operates with discipline, documentation, and data integrity.

Connecting Demand Generation to Pipeline Predictability

Predictability is one of the most important value drivers for CFOs. Demand generation provides the early-funnel structure needed for stable quarterly performance. When programs are consistent, CFOs see improvement in:

- Quarterly pipeline reliability

- Conversion trends

- Forecast accuracy

- Reduced reliance on late-quarter activity

- More balanced revenue pacing

CFOs evaluate budgets not only on return but on the stability those budgets create. Predictable demand generation reduces risk during planning cycles and strengthens confidence in strategic decisions.

Addressing Budget Concerns with Realistic Scenarios

CFOs respond well to scenario-based justification. Marketing can outline best-case, expected, and conservative projections showing how budget levels influence pipeline and revenue. This approach demonstrates discipline and provides CFOs with a range of outcomes that support budgeting decisions.

This can include:

- Expected pipeline impact from incremental investment

- Impact of reduced budget on funnel performance

- Break-even analysis for new programs

- Scenarios tied to market conditions or demand patterns

CFOs are accustomed to scenario modeling. Providing structured projections helps build trust and transparency.

Improving Cross-Functional Alignment for Budget Clarity

Clear communication between finance, marketing, and sales strengthens budget justification. CFOs appreciate teams that coordinate KPIs, create shared reporting structures, and maintain alignment throughout the funnel. Consistent communication reduces confusion, supports unified forecasting, and demonstrates operational maturity.

This alignment also helps CFOs evaluate investments holistically instead of viewing them as isolated line items.

Strengthen Your Revenue Planning Today with Televerde

A strong demand generation budget is easier for CFOs to justify when financial outcomes and operational structures are clearly connected. When marketing demonstrates both efficiency and consistency, demand generation becomes an investment that stabilizes revenue and supports long-term growth.

Connect with Televerde to assess demand generation strategies that support predictable pipeline performance and a more efficient path to revenue.