How CFOs Evaluate ROI of Marketing Investments

Chief Financial Officers play a key role in validating every business investment, and marketing is no exception. As data-driven accountability becomes central to every department, CFOs are examining how marketing contributes to revenue growth, customer retention, and long-term profitability.

Understanding how CFOs evaluate ROI helps marketing and sales leaders align budgets, build stronger business cases, and prove the value of every campaign.

Quick Takeaways

- CFOs evaluate marketing ROI through data accuracy, efficiency, and measurable financial outcomes.

- Alignment between marketing and business goals strengthens ROI visibility.

- Reliable attribution and performance data increase CFO confidence in marketing spend.

- Clear communication of results supports stronger marketing–finance collaboration.

1. ROI as a Financial Measure

CFOs view ROI as a financial metric that reflects efficiency and profitability. They focus on how much revenue marketing generates relative to the total cost of acquisition. Every investment, from paid campaigns to lead generation programs, is expected to produce measurable returns.

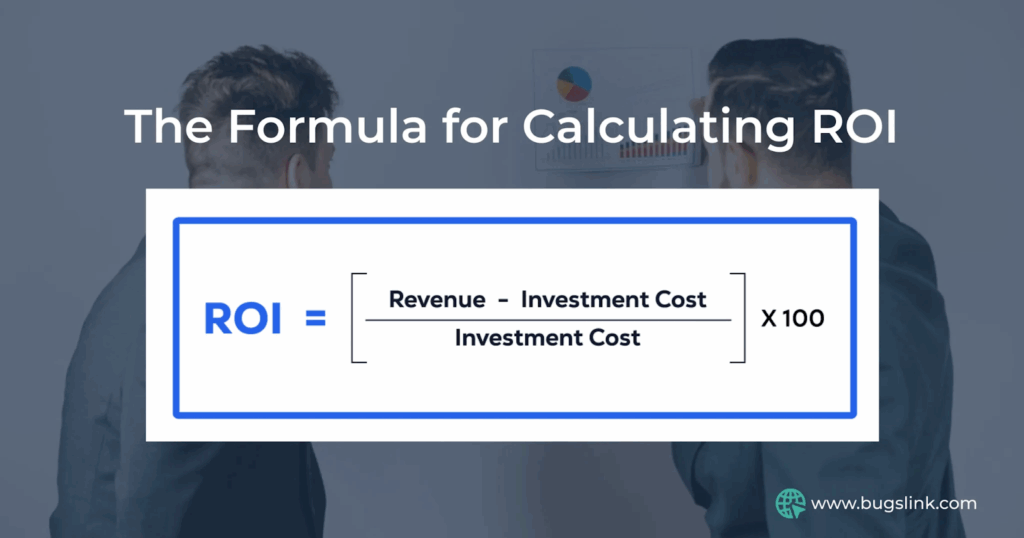

Marketing ROI is typically calculated using the formula:

Marketing ROI = (Revenue Attributed to Marketing – Marketing Spend) / Marketing Spend × 100

This number helps CFOs assess which initiatives truly drive business value. High ROI signals strong marketing performance, while low ROI indicates a need for adjustment or reallocation of funds.

2. Alignment with Business Goals

CFOs expect marketing to tie every initiative to a measurable business objective. Whether the goal is revenue growth, market share expansion, or customer retention, they look for clear alignment between marketing activities and overall strategy.

This evaluation often begins with shared KPIs. Marketing might focus on qualified leads and conversion rates, while finance measures profitability and customer lifetime value. The strongest ROI cases bridge both sets of metrics, demonstrating how marketing outcomes drive tangible financial results.

3. Cost Efficiency and Budget Allocation

For CFOs, ROI is not just about performance but about efficiency. They assess how effectively marketing allocates resources across channels and audiences. High-performing organizations continuously evaluate spend to eliminate waste and maximize impact.

CFOs often look for:

- Cost per lead or acquisition: Indicates how efficiently marketing converts interest into sales opportunities.

- Customer lifetime value (CLV): Shows the long-term revenue potential from each acquired customer.

- Payback period: Measures how quickly marketing investments return their initial cost.

These financial indicators help CFOs understand whether marketing is optimizing spend or overspending for marginal gains.

4. Revenue Attribution and Data Accuracy

Accurate revenue attribution is essential for credible ROI reporting. CFOs evaluate the systems and processes used to track performance across channels. Incomplete or inconsistent data can erode confidence in marketing’s impact.

Advanced analytics tools, CRM systems, and integrated marketing automation platforms allow teams to link conversions directly to campaigns. CFOs rely on this visibility to distinguish between activity-based metrics (like impressions or clicks) and actual revenue contribution.

When data accuracy improves, finance leaders are more likely to support expanded marketing budgets because they can verify that each dollar spent leads to measurable outcomes.

5. Predictability and Scalability of Results

Finance leaders value predictability. They prefer marketing programs that can consistently deliver measurable outcomes over one-time campaigns with uncertain results. Predictable ROI allows for accurate forecasting and more strategic budget planning.

Scalability also matters. CFOs evaluate whether successful marketing programs can be expanded to new regions, segments, or product lines without eroding efficiency. When marketing demonstrates scalable success, it becomes easier for CFOs to justify continued or increased investment.

6. Short-Term vs. Long-Term ROI

Marketing ROI can be difficult to evaluate because returns often extend over long periods. While sales campaigns may generate immediate results, brand awareness and content strategies typically show impact over months or even years.

CFOs balance both perspectives by segmenting marketing spend into short-term and long-term categories. They expect regular performance updates and trend analysis that highlight how brand equity, customer engagement, and pipeline growth contribute to future revenue.

A well-structured ROI report reflects both immediate returns and the cumulative value of sustained marketing investment.

7. Risk Management and Accountability

CFOs are responsible for protecting company resources. When evaluating marketing ROI, they assess risk as much as potential return. This includes reputational risk from campaigns that miss the mark, as well as financial risk from unproven strategies.

They expect clear accountability frameworks within marketing departments: defined ownership of budgets, transparent reporting, and controls that prevent wasteful spending. CFOs also look for built-in feedback loops that enable quick course corrections when performance lags behind expectations.

When marketing operates with strong governance and reporting discipline, it builds credibility with finance leadership.

8. Integration of Marketing and Sales Metrics

For many CFOs, marketing ROI cannot be evaluated in isolation. They analyze performance across the full revenue funnel to understand how marketing-qualified leads progress into opportunities and closed deals.

Cross-functional collaboration between marketing, sales, and finance is essential. Shared dashboards, joint forecasting, and consistent data definitions help eliminate reporting gaps. CFOs value this integration because it provides a complete view of how marketing spend translates into revenue outcomes.

This transparency strengthens confidence in marketing’s financial contribution and supports more accurate strategic planning.

9. Technology and Automation as ROI Drivers

CFOs increasingly recognize the role of technology in maximizing marketing ROI. Automation tools improve efficiency, reduce manual effort, and deliver more consistent performance tracking.

Technologies such as predictive analytics, AI-driven segmentation, and performance dashboards give CFOs the insight they need to evaluate marketing at a granular level. These tools also support real-time decision-making, allowing finance leaders to adjust budgets dynamically based on evolving performance data.

The ability to connect financial systems with marketing analytics gives CFOs a complete picture of costs, conversions, and profitability; key to achieving transparent ROI measurement.

10. Communicating ROI to the CFO

Marketers who can present ROI in financial language earn stronger advocacy from CFOs. This means focusing on measurable outcomes rather than campaign activity.

Instead of emphasizing engagement rates or website traffic, reports should link metrics directly to revenue, pipeline contribution, or cost savings. CFOs appreciate concise dashboards that connect marketing outcomes to strategic priorities such as market expansion or product growth.

Clear communication backed by reliable data ensures that marketing investments are viewed as value drivers rather than discretionary expenses.

Build Financial Confidence in Marketing Today with Televerde

CFOs evaluate marketing ROI through the same lens they apply to any business investment: accuracy, efficiency, and return potential. Their assessment combines financial analysis, risk management, and strategic alignment.

Marketing teams that understand this perspective can build stronger partnerships with finance. By demonstrating measurable impact, they secure greater trust, sustained budgets, and a more significant voice in company strategy.

Ready to improve how your marketing performance translates into measurable business value? Discover how Televerde helps marketing and sales teams demonstrate ROI that resonates with CFOs. Schedule a consultation today.