How to Boost Your ESG Rating and Attract Solid Investors

To compete in today’s market, it isn’t enough to provide the highest quality product at the best price. Today’s consumers demand more from brands, especially when it comes to social consciousness. A company’s environmental, social, and governance (ESG) rating is becoming increasingly important to its overall success.

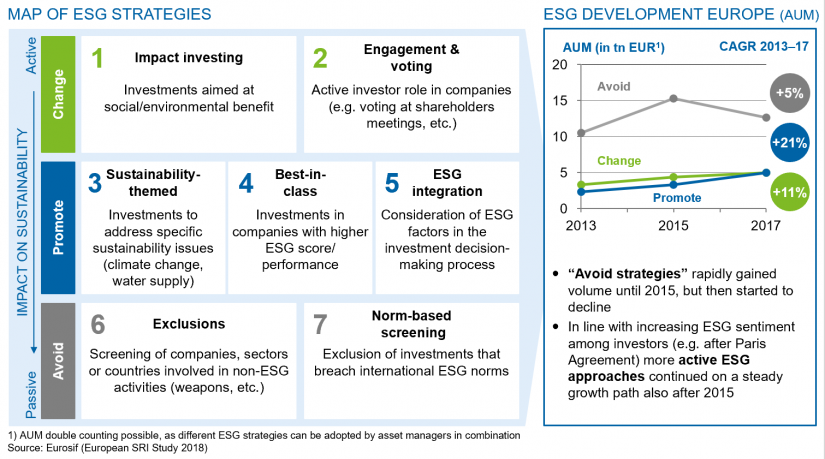

Consumers aren’t the only ones concerned with ESG ratings. Today’s investors use this calculation to screen prospective investments. If small and mid-sized businesses want to attract solid investors, they need to find ways to increase their ESG rating for financial security. This will help boost sales growth, increase demand generation, and generate even more revenue.

Quick Takeaways

- An ESG rating helps investors identify potential investment opportunities based on a company’s environmental, social, and governance standards.

- Third-party organizations measure ESG ratings. They assess data businesses provide and rate them on a scale of 0-100.

- Attract solid investors by increasing your ESG rating in five easy steps.

What Exactly is an ESG Rating?

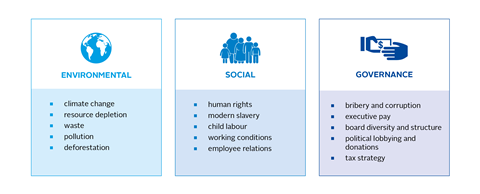

As social consciousness becomes more prevalent in our society, investors are prioritizing social awareness and focusing on responsible investing. An ESG rating is a set of standards that helps to assess a company’s social responsibility in three areas:

- Environmental: How a company’s operations impact nature. Global warming, energy efficiency, and waste management are important factors in this category.

- Social: How a company manages relationships with people and communities. This includes labor standards, workplace safety, and community involvement.

- Governance: A set of principles outlining responsibilities, rights, and expectations between the company and its stakeholders. This includes company leadership and executive pay.

By assessing this set of criteria, investors can identify businesses whose priorities toward ESG are in alignment with their own. They can also recognize companies that may be a potential risk. If your company doesn’t have a socially responsible means for waste disposal or there aren’t systems in place for ensuring employee health and safety, an investor is unlikely to commit to your business. The following video explains ESG in more detail.

How is an ESG Rating Calculated?

ESG ratings are scored out of 100, the maximum rating a company can achieve. Third-party review and research organizations perform the assessment and measurement that form the basis of the scoring.

These organizations typically create their ESG reports annually. First, they collect publicly available ESG data that a company discloses. This data can include sustainability reports, annual reports, websites, public sources, and direct communication with company officials. ESG data is then checked and standardized for study.

Organizations score companies based on data points covering things like pollution, diversity practices, and audits. Presenting up-to-date and accurate data about your company is essential to earn a high ESG rating. These services can penalize companies that don’t provide complete data.

5 Ways to Boost Your ESG Rating

ESG-driven businesses see numerous benefits and are more likely to have a better understanding of their company. This enables them to mitigate risks and take advantage of opportunities that will help them succeed and thrive. Such businesses are attractive to solid investors who want to ensure their investments are financially (and socially) sound. Managing ESG can be challenging, but here are five ways you can boost your ESG rating to attract solid investors.

1. INGRAIN ESG IN YOUR COMPANY’S CULTURE

ESG is more than a checklist of to-do items. It has to be something that’s ingrained into your company’s culture and serves as a driving force behind the decisions you make and the actions you take. When initiatives are authentic and focused on ethical behavior, sustainability, and social awareness, they propel your business toward real social change. As a result (and an added benefit), you’ll see a higher ESG rating.

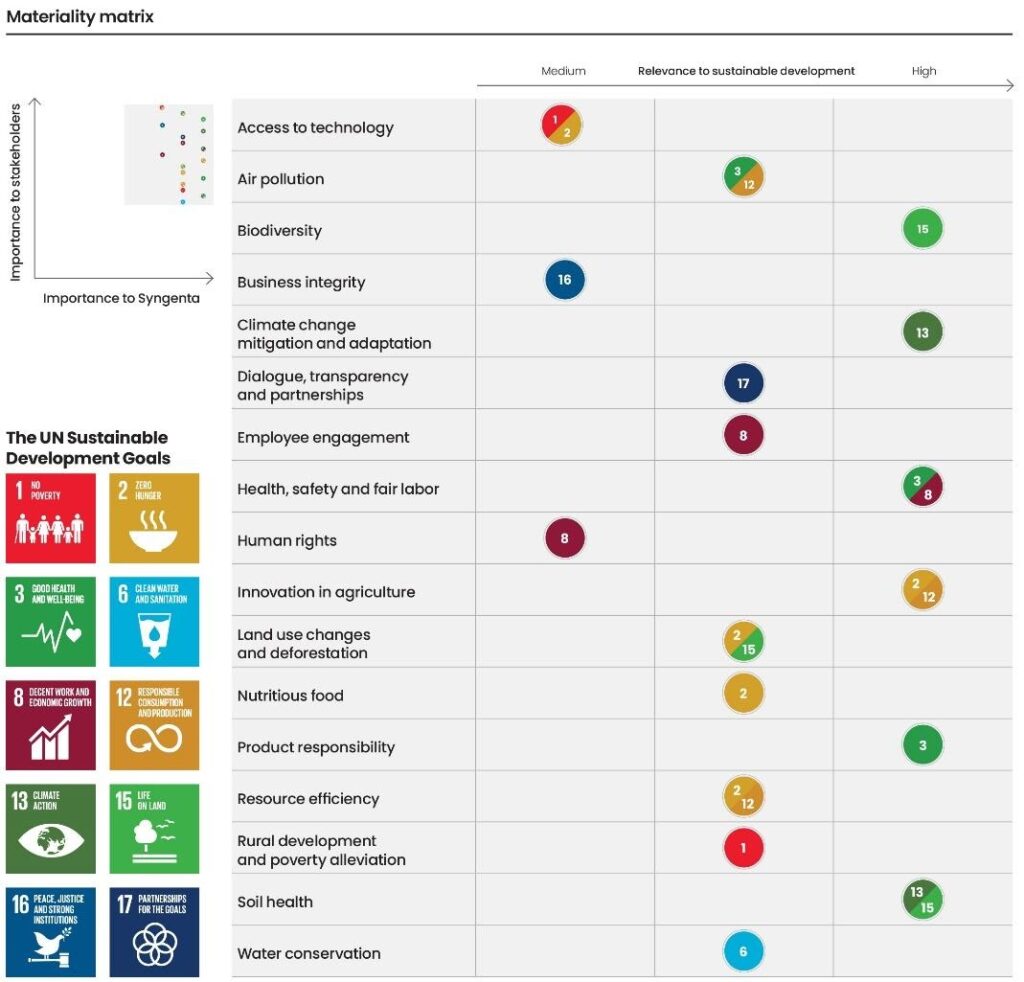

2. CONDUCT A MATERIALITY ASSESSMENT

It can be difficult to know what non-financial information matters and what should be reported. A materiality assessment helps to identify the ESG topics that are most important to your business and your investors. When you understand the areas that investors are critically analyzing, you can focus your efforts and strategy accordingly. This assessment can align and improve business processes and report with more accuracy and clarity. All of this can help increase your ESG rating.

3. STAY ATTUNED TO YOUR RATINGS

Investors and stakeholders constantly investigate your ESG ratings. For this reason, your score should be at the front of your mind in all you do. To boost your ESG rating, you must first understand where you’re succeeding and what needs improvement. Engage with rating agencies and their reports frequently. With constant, thorough evaluation, you can improve your efforts, boost your ESG rating, and communicate the data that is most important to your investors.

4. FOLLOW GLOBAL FRAMEWORKS

Global standards help to provide consistent, reliable information to investors. While there isn’t a global consensus on standards for reporting ESG information, investors often use several frameworks when making their investment selections. Explore the following:

- Global Reporting Initiative (GRI): the most widely used standards for ESG reporting

- Sustainability Accounting Standards Board (SASB): helps businesses disclose financially material information

- Task Force on Climate-Related Financial Disclosures (TCFD): set of recommendations that support reliable climate-related disclosures

These global frameworks serve as a guide to help businesses establish a more strategic approach to ESG that can increase ratings and appeals to investors.

5. PROVIDE INVESTMENT-GRADE DATA

When seeking potential investment opportunities, investors look for ESG information that is consistent, accurate, comparable, and clear.

When compiling ESG data, follow these criteria to achieve investment-grade data:

- Accuracy: Use thorough data collection systems.

- Boundaries: Data should encompass the fiscal year and business ownership model.

- Consistency: Use reliable global standards to ensure comparability.

- Data provision: Submit raw and normalized data.

- Timeliness: Data should align with the annual reporting cycle.

- External assurance: Have a third party evaluate your information.

- Balance: Present fair and unbiased information that reports positives and negatives.

Presenting ESG information with these criteria in mind will ensure you’ve provided the information needed for a favorable ESG rating.

Boost Your ESG Rating

Televerde creates solutions to develop lead generation, boost engagement, and drive sales through your pipeline. We can help you uncover the data you need to grow as a business and understand how your community perceives you.

Want help assessing your ESG rating? The Televerde Resource Library is filled with webinars and tools to help you meet your goals.