How Big Is Your Total Addressable Market (TAM)?

In the world of business, understanding the scale of opportunity is as crucial as the execution of ideas. Total addressable market (TAM) offers a glimpse into this scale, representing the overall revenue potential that a product or service could achieve in its market if it were to reach maximum penetration.

TAM is not just a number—it’s a vital indicator of a market’s potential that guides companies in strategic decision-making and investment targeting. Calculating it accurately is indispensable for businesses seeking to align their product development and marketing strategies with realistic market opportunities.

It ensures that resources are allocated efficiently and that business plans are grounded in measurable potential rather than mere speculation. Whether you’re a startup pitching to investors or a multinational planning to enter new geographic territories, a well-defined understanding of TAM can differentiate between strategic success and misadventure.

In this guide, we’ll define TAM in more detail and walk step-by-step through the process of calculating it accurately to inform key decisions and strategies.

Quick Takeaways:

- Total addressable market quantifies the entire existing revenue opportunity for a product or service if it were to achieve maximum market penetration.

- Serviceable addressable market and serviceable obtainable market are related concepts that help businesses understand the portion of the market they can realistically capture.

- There are multiple methods for calculating total addressable market, including top-down, bottom-up, and value theory.

- It’s important to be aware of potential biases when calculating TAM. You can combat biases by using objective data and considering multiple perspectives.

What Is Total Addressable Market?

Total Addressable Market (TAM) quantifies the entire revenue opportunity that exists for a product or service if it were to achieve maximum market penetration. It represents the upper limit of market demand for a specific offering in both monetary and volume terms, assuming every potential customer is reached and converted.

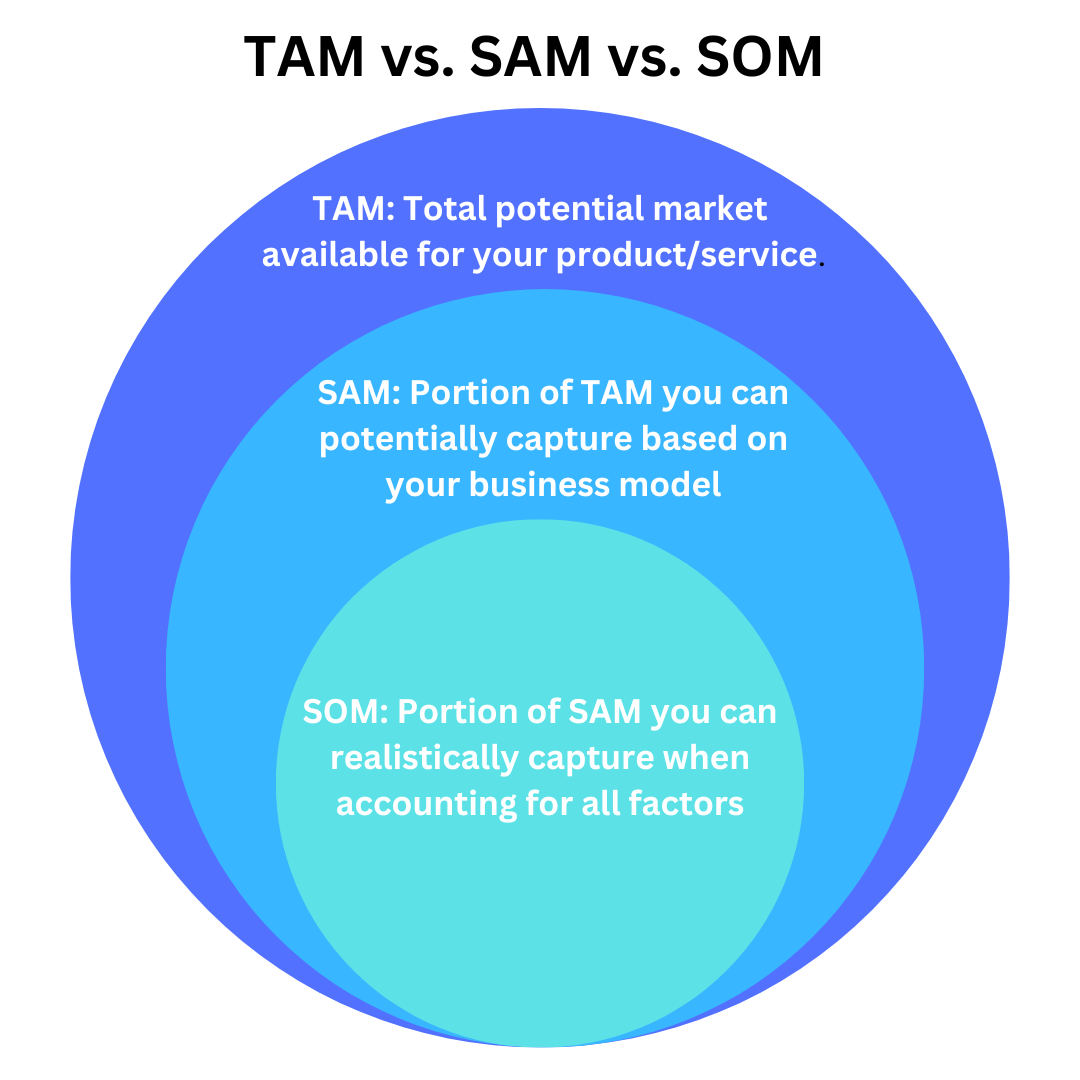

Related closely to TAM are two other important metrics:

- Serviceable Addressable Market (SAM): The segment of TAM that your business can actually serve, defined by the geographical reach and operational limits of your company, filtering TAM to only those areas you can realistically target

- Serviceable Obtainable Market (SOM): Narrows down SAM to account for competition and other market factors, representing the portion of SAM that your business is likely to capture

Source: Original

Alt-Text: Diagram highlighting the relationships between total addressable market, serviceable obtainable market, and serviceable available market

By differentiating these three key metrics, your business can methodically scale its strategies:

- Start with TAM for a high-level view of the market potential.

- Narrow down to SAM for actionable planning in reachable segments.

- Focus on SOM for operational targets and performance tracking in the immediate market landscape

This tiered approach can help your teams make informed, strategic decisions by understanding not just the potential market size, but also the realistic opportunities that can be pursued effectively.

The Role of TAM in Shaping Business Strategy

Total addressable market plays a critical role in shaping business strategy by providing a broad perspective on potential market opportunities. It informs key strategic decisions across various aspects of business operations, from market entry to product development and competitive positioning:

Market Entry Decisions

By evaluating TAM, companies can determine the overall market potential for a new product or service, helping to identify whether an entry into a particular market is viable and promising. This involves not only looking at the current size of the market but also its growth potential, which can guide investment and resource allocation decisions.

Product Development

TAM helps with identifying the potential customer base for a product, which in turn influences product features, design, and development. Knowing the size of the market can prioritize which features are essential for meeting the needs of the largest possible customer base, or identify niche markets that may be underserved.

Competitive Positioning

Understanding the TAM allows companies to benchmark their expected market share against the total market capacity, offering insights into how much of the market might be penetrable. This can be critical for setting competitive pricing, marketing strategies, and customer service enhancements to capture a larger share of the market.

In all of these cases, a well-understood and calculated TAM provides companies with the leverage to secure substantial investments and guide growth strategies effectively, serving as the foundation for robust and informed strategic planning.

Methods for Calculating Total Addressable Market

There are several methods you can employ to calculate total addressable market, each with its own advantages and considerations. Let’s walk through these methods together:

- Top-Down Approach

This method starts with a broad view of the market and gradually narrows down based on demographic and psychographic factors. It typically involves analyzing industry reports, market research data, and macroeconomic indicators to estimate the overall market size.

From there, you can segment the market based on factors such as geography, age, income level, and consumer behavior to arrive at a more precise TAM figure.

- Bottom-Up Approach

Conversely, the bottom-up approach begins with specific data on customer transactions and builds up to estimate the total market size. This method involves collecting data on current customers, analyzing their purchasing behavior, and extrapolating this data to the broader market.

By scaling up from individual transactions, businesses can gain insights into market demand and identify potential growth opportunities.

- Value Theory

Another method for calculating TAM is through value theory, which estimates market size based on the perceived value of the product or service. This approach involves assessing the unique value proposition of the offering, understanding customer needs and preferences, and determining the price sensitivity of the target market.

By quantifying the value that customers derive from the product or service, businesses can estimate the total market opportunity.

It’s important to note that each of these methods has its own limitations and potential biases. Market dynamics, such as changes in consumer behavior, technological advancements, and evolving competitive landscapes can also impact TAM calculations. In addition, variations in data sources, assumptions, and methodologies can lead to discrepancies in TAM estimates. For these reasons, it’s essential to critically evaluate your data and consider multiple perspectives when estimating TAM.

Wrapping Up

A well-understood and accurately-calculated total addressable market is not just a number—it’s a strategic tool that can shape investment decisions, guide product development, and fine-tune market entry strategies.

Making TAM a core part of your strategic planning ensures every step your business takes is informed, purposeful, and poised for maximum impact. With the right approaches to calculating and applying TAM insights, your business can not only identify but also effectively capitalize on its true growth potential.

Ready to unlock your market’s full potential? Contact us to learn how Televerde’s leading demand gen, sales, and customer experience solutions can maximize growth for your business.