CapEx vs. OpEx: A Quick Guide

Financially managing a B2B business requires a deep understanding of capital expenditures (CapEx) and operating expenses (OpEx), two distinct yet complementary contributors to business success. Knowing the differences between CapEx vs. OpEx and how to balance them together is crucial to simultaneously achieving operational efficiency and long-term growth.

In this quick guide, we’ll explore CapEx and OpEx separately, compare them directly, and then explore how the smartest financial management teams leverage both to help their organizations win.

Quick Takeaways:

- CapEx are large investments that contribute to long-term success, while OpEx are smaller and usually recurring expenses that support day-to-day operations.

- CapEx typically comes with higher risk due to their size and long-term investment, but managing OpEx effectively is also crucial for ongoing financial health.

- Focus on CapEx vs. OpEx may shift over time depending on organizational goals and needs.

- Strategically balancing CapEx vs. OpEx in an ongoing way is essential for businesses to perform well while continuously making progress toward larger objectives.

What is CapEx?

CapEx refers to any funds used by businesses to acquire, upgrade, and maintain significant assets such as property, industrial buildings, technology infrastructure, patents, and equipment. CapEx is geared toward making investments in a business that will support its long-term success.

Specific examples of CapEx include:

- New property to expand business operations

- Equipment to enhance or scale capabilities

- New assets to replace old or outdated versions

- Technology infrastructure

On financial statements, CapEx appears as an asset on the balance sheet to reflect its role as an investment. Over time, these assets are depreciated (for tangible assets) or amortized (for intangible assets), impacting both the balance sheet and income statement.

Capital expenditures often qualify for tax benefits that can help to offset their up-front costs. Businesses can then typically write off the depreciation of these assets over their useful lives, providing a tax shield and thus impacting cash flow positively.

CapEx plays a vital role in the growth and sustainability of B2B businesses, enabling them to expand and improve their operational capabilities. Understanding and managing CapEx effectively is crucial for long-term strategic planning and financial health.

What is OpEx?

OpEx refers to ongoing costs that a business incurs as part of its normal day-to-day operations. Unlike CapEx, which is focused on long-term investments, OpEx covers expenditures that are necessary for the company’s immediate operational needs and are generally shorter-term in nature.

Specific examples of OpEx include:

- Salaries and wages for employees

- Rent and utilities for office spaces

- Repair and maintenance costs

- Marketing and advertising expenses

- Office supplies and software subscriptions

In financial statements, OpEx is typically accounted for on the income statement. These expenses are deducted from the company’s revenue to calculate the net income for the period. Since OpEx does not include the acquisition of long-term assets, these expenses are deducted in the accounting period in which they are incurred.

Unlike CapEx, Operating Expenses do not usually provide significant tax benefits as they are considered part of the normal cost of running a business. However, efficiently managing OpEx is critical to maintain healthy cash flow and profitability.

CapEx vs. OpEx: Key Differences

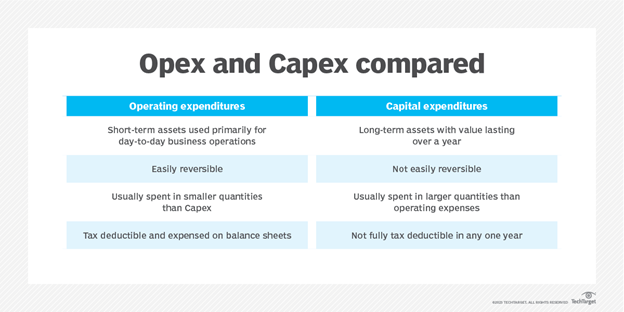

Understanding the differences between CapEx vs. OpEx is crucial for any B2B business as it influences budgeting, strategic planning, and overall financial management. Here’s a comparative analysis of both that highlights their distinct characteristics:

- Nature of Expenditure: While CapEx requires major investments with the intent of long-term value creation (typically more than one year), OpEx costs are short-term and recur regularly. In addition, OpEx can be easily reversed, while CapEx cannot.

- Financial Implications: The financial implications of CapEx are spread over the life of the asset, while OpEx are fully expensed in the period they are incurred.

- Risk Factors: Risks associated with CapEx are generally higher due to the larger sums of money involved and the long-term commitment, while OpEx are lower in risk due to their routine nature and smaller size. Still, mismanagement of OpEx can lead to cash flow problems and affect short-term financial health.

For B2B businesses, balancing investment in CapEx vs. OpEx often depends on the company’s financial position, future growth plans, and the specific nature of the expense. Investment in CapEx may be more important when long-term growth is at the top of the priority list, while OpEx may get more focus as a business works to optimize day-to-day functions.

How CapEx and OpEx Work Together

In the landscape of B2B business operations, the interplay between CapEx and OpEx is a fundamental aspect of strategic financial management. Understanding and managing this dynamic is crucial for both short-term operational efficiency and long-term growth.

The synergy between CapEx and OpEx lies in how they complement each other. CapEx, with its focus on long-term investments in assets, lays the groundwork for a company’s future growth and expansion. These investments, such as in new technology or facilities, enable businesses to enhance their capabilities and increase their market competitiveness. However, these are not frequent expenses and require substantial initial outlays, with benefits accruing over time.

On the other hand, OpEx covers the day-to-day expenses essential for keeping the business running, and these recurring costs, such as employee salaries, utilities, and maintenance, ensure that the company’s operations are smooth and uninterrupted. These expenses are immediate and unavoidable, forming the backbone of daily business activities.

A strategic balance between CapEx and OpEx is crucial. Overinvestment in CapEx without adequate focus on OpEx can lead to cash flow issues, hampering the company’s ability to manage day-to-day operations. Conversely, excessive emphasis on OpEx at the expense of CapEx can stifle growth and innovation.

Effective financial management involves assessing the optimal allocation between CapEx vs. OpEx based on the company’s current objectives, market conditions, and long-term vision. This requires a thorough understanding of the nature of these expenditures as well as insight into the company’s growth trajectory and operational needs.

For B2B businesses, success hinges on the ability to smartly invest in CapEx for future growth while efficiently managing OpEx for operational excellence. Balancing these expenditures is key to maintaining a healthy financial position, ensuring both stability and agility in a fast-evolving market landscape.

Learn more here about how Televerde can help you balance your long-term vision with short-term performance goals.